Ohio Retirement Income Credit Worksheet

This income is included in your adjusted gross income on Ohio IT 1040 line 3. Step 1 - Monthly expenses.

Individual Income Tax Return Ohio Free Download

Your adjusted gross income less exemptions Ohio IT 1040 line 5 is less than 100000.

Ohio retirement income credit worksheet. Taxpayers can claim a credit based on the total amount of retirement income included in their Ohio adjust gross income. Ad Download over 20000 K-8 worksheets covering math reading social studies and more. Retirement income planning worksheet Estimating retirement expenses and income will help determine how well prepared you are to meet your retirement savings goals.

Retirement income includes retirement benefits annuities and pension or profit-sharing distributions. Discover learning games guided lessons and other interactive activities for children. Social Security retirement benefits are fully exempt from state income taxes in Ohio.

Instead of the retirement income credit a taxpayer who receives a total lump sum distribution may be able to claim a lump sum retirement credit. These amounts must be included in state adjusted gross income. THIS MATERIAL IS FOR GENERAL USE WITH THE PUBLIC AND IS NOT.

This worksheet is designed to help you begin gathering this information. Discover learning games guided lessons and other interactive activities for children. To do this you must understand the types of retirement income and the forms used to report them.

Please enclose with your Ohio individual income tax return Ohio form IT 1040 or with your amended Ohio individual income tax return a copy of this worksheet and a copy of your form 1099R issued by the company or retirement plan that made the lump sum distribution. Table 2 Retirement income included in Ohio adjusted gross income Retirement income credit 0 0 502 500 50150 1500 1501176 3000 3001168 473 5000 5001 130 53 8000 8001 200or more 25 50 80. The credit is calculated using the following table.

Both property and sales tax rates are higher than national marks. Income Retirement Income 11-1 Income Retirement Income Introduction This lesson will help you identify and report the taxable portion of retirement income received by the taxpayer. If you deduct an amount on Schedule A of your Ohio return you may not be entitled to the joint filing credit unless each spouse has other sources of qualifying income totaling 500 or more included in Ohio Adjusted Gross Income.

1 released the Lump Sum Retirement Credit Worksheet for individual income tax purposes. Individuals who have previously taken the OH Lump Sum Retirement Income Credit. 2 Retirement Income 2 3 Railroad Retirement 3 4 Veterans 4 5 Pensions 5 6 Net Rental Income 6 7 Alimony 7 8 Child Support 8 9 Estate or Trust Fund 9 10 Interest Income 10 11 Dividends.

The Ohio Department of Taxation Oct. This worksheet is designed to help you begin gathering this information. Retirement Income Calculator Use this calculator to determine how much monthly income your retirement savings may provide you in your retirement.

309 Page 2 Table 1 Retirement Income Credit Table Amount of qualifying retirement income received and included in Ohio adjusted gross income during the taxable year Retirement income credit for the taxable year 500 or less 0. Step 1 - Monthly Expenses. Please enclose with your Ohio individual income tax return Ohio form IT 1040 or with your amended Ohio individual income tax return a copy of this worksheet and a copy of your form 1099R issued by the company or retirement plan that made the lump sum distribution.

- 2 - LS WKS Rev. Certain income from pensions or retirement accounts like a 401k or an IRA is taxed as regular income but there are credits available. To qualify for the Ohio Retirement Income Credit you must meet all of the following criteria.

Housing Essential Expenses Non-Essential Expenses MortgageRent Primary. Your annual savings expected rate of return and your current age all have an impact on your retirements monthly income. Qualifying income does not include income from interest dividends distributions royalties rents capital gains and state or municipal income tax refunds.

You received retirement benefits annuities or distributions that were made from a pension retirement or profit sharing plan. Ohio Department of Medicaid ODM. Sum distribution in your Ohio adjusted gross income line 3 on Ohio form IT 1040.

View the full report to see a year-by-year break down of your retirement savings. - 3 - Ohio Lump Sum Retirement Credit Worksheet 1991 and subsequent taxable. Annual senior citizen credit of 50 on any return to which you are a party.

Ad Download over 20000 K-8 worksheets covering math reading social studies and more. FINANCIAL ASSESSMENT WORKSHEET. If the taxpayer or spouse meets all of the requirements the Retirement Income Credit will calculate and carry to OHSCHCR page 1 line 2.

The maximum credit per return is 200. Retirement Income Planning Worksheet Estimating your retirement expenses and income will help you determine how well prepared you are to meet your retirement savings goals. B A credit shall be allowed against a taxpayers aggregate tax liability under section 574702 of the Revised Code for taxpayers who received retirement income during the taxable year and whose modified adjusted gross income for the taxable year less applicable exemptions under section 5747025 of the Revised Code as shown on an individual or joint annual return is less than one.

Lump sum retirement credit. Overview of Ohio Retirement Tax Friendliness.

Financial Statements Template Ireland The Modern Rules Of Financial Statements Templa Personal Financial Statement Financial Statement Financial Plan Template

Paying Your Debt Can Be A Challenging Job And It Requires Money Management In Other Word Paying Off Credit Cards Business Credit Cards Credit Card Payoff Plan

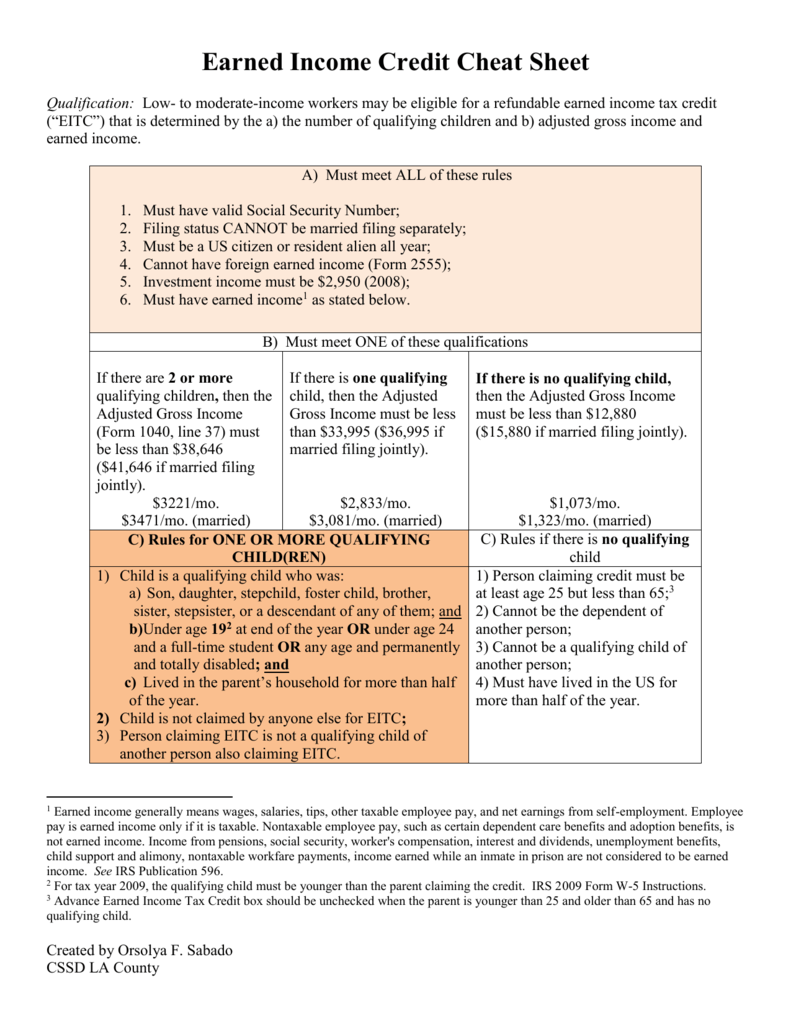

Earned Income Tax Credit Definition

See The Eic Earned Income Credit Table Income Tax Return Income Federal Income Tax

Eic Frequently Asked Questions Eic

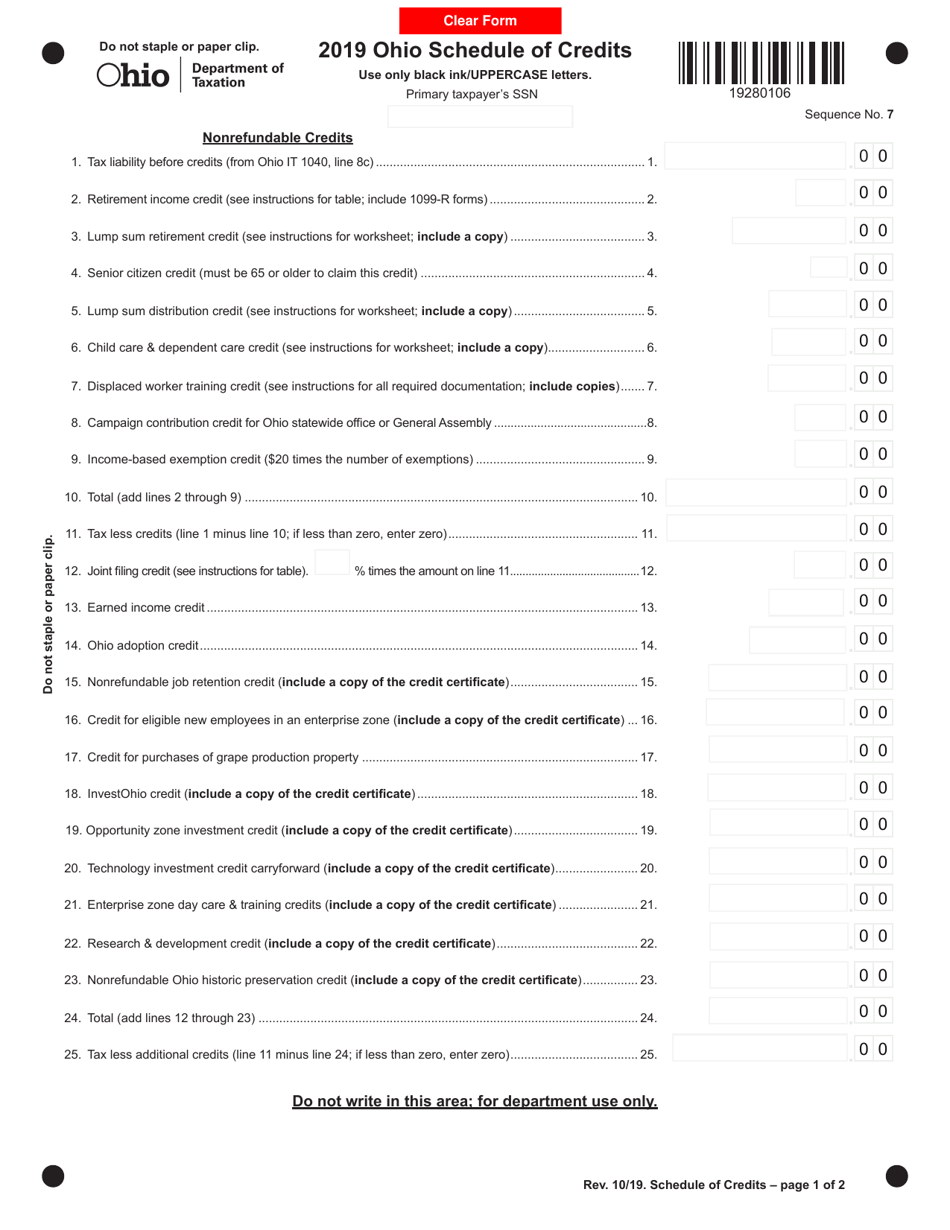

2019 Ohio Ohio Schedule Of Credits Download Fillable Pdf Templateroller

2020 Instructions For Schedule H 2020 Internal Revenue Service

See The Eic Earned Income Credit Table Income Tax Return Income Federal Income Tax

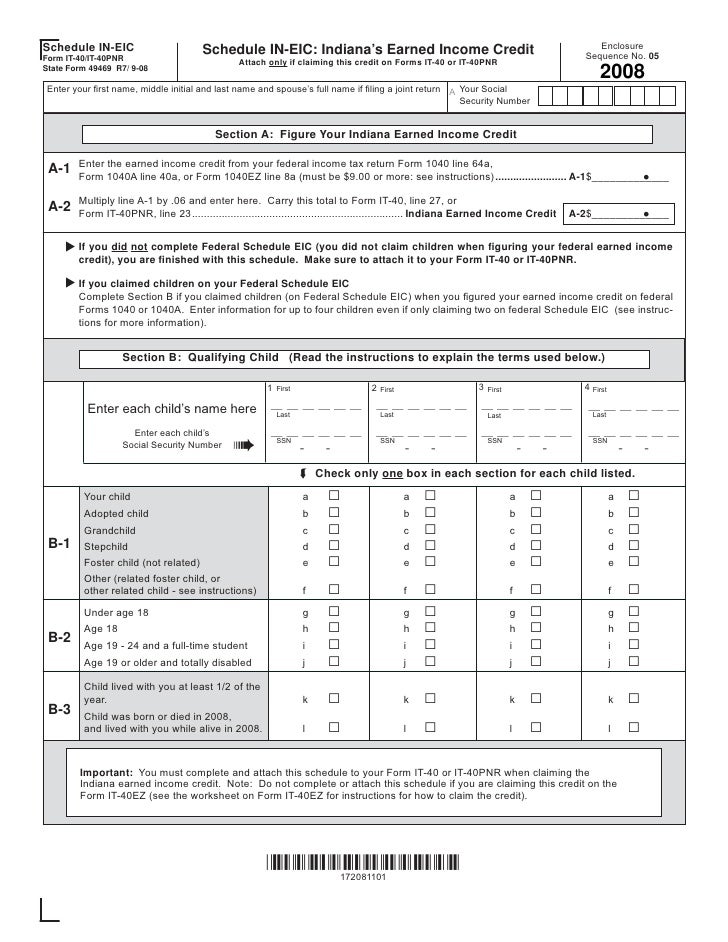

Http Www Zillionforms Com 2016 F509082475 Pdf

You Need Millions To Retire And More Misconceptions About Retirement Savings Marketwatch Saving For Retirement Misconceptions Retirement

Publication 908 02 2021 Bankruptcy Tax Guide Internal Revenue Service

Http Www Tax Ohio Gov Portals 0 Forms Ohio Individual Individual 2012 Pit 2012 Scheduleb Fi Pdf

2008 It 40 Income Tax Booklet With Forms And Schedules

Total Compensation Statement Excel Template Free Smart With Credit Card Stat Personal Financial Statement Financial Statement Templates Credit Card Statement

Publication 908 02 2021 Bankruptcy Tax Guide Internal Revenue Service

1040 2017 Internal Revenue Service Worksheets Educational Worksheets Budget Forms